In 1986, the Vietnamese authorities launched the Đổi Mới reform, a radical restructuring of the economy that gradually allowed private enterprise and property ownership.

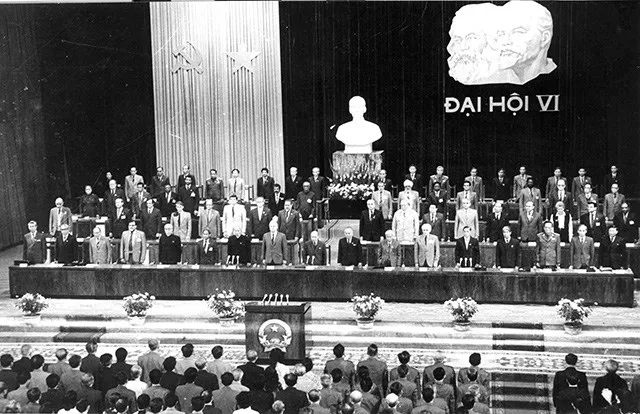

The Vietnam Communist Party’s 6th National Congress enacted the Đổi Mới policy

This transformative policy marked the beginning of decades of sustained economic growth, lifting millions of people out of poverty.

For the beer industry, Đổi Mới brought two significant changes:

- A surge in beer consumption: As disposable income grew, beer consumption in the country increased dramatically. In the early 1990s, national beer consumption was estimated at about 2–3 liters per person per year. Today, this figure exceeds 45 liters!

- Opportunities for private and foreign investment: Private companies, including foreign firms, were progressively allowed to invest in this market.

This context attracted billions of dollars in private capital and fueled intense competition, shaping the beer industry we know today.

💡 An History Beer in Vietnam – The project

This is the third article in a series exploring the history of beer in Vietnam. The full list of articles can be found below:

- Part 1: The Early Days

- Part 2: Colonial Capitalism

- Part 3: The War for Independence and the Nationalizations

- Part 4 : Brewing in a Socialist Economy

- Part 5: Đổi Mới—The Golden Opportunity for Multinational Firms

If you think any key information is missing, feel free to share additional sources on this topic. I’m far from finished writing about beer in Vietnam!

1. The Failed Return of BGI – Castel

Among the international companies that began eyeing the Vietnamese market upon hearing of the winds of reform, one name already familiar to the country stands out: BGI.

The Brasserie et Glacière d’Indochine, renamed Brasserie et Glacière Internationale in 1975, continued to expand its business, particularly in Africa, as mentioned in a previous article.

Integrated into the Castel Group in the early 1990s, the company had both the resources and ambition to reenter the Vietnamese market. After failing to reach an agreement in Ho Chi Minh City for the historical site at 187 Đ. Nguyễn Chí Thanh, the company opted to build a new production facility in Mỹ Tho (Tiền Giang Province), investing a total of $43 million in the project.

In 1994, BGI products returned to the Vietnamese market, including La Rue beer with its famous tiger logo, the eponymous BGI Beer, and a selection of sodas.

This investment in Kien Giang was just the first phase of an ambitious plan by the Castel Group to expand across Vietnam. Da Nang and Hai Phong were identified as the next steps in a deployment strategy that aimed to cover the entire country, with a total investment projected to reach $110 million.

Despite these efforts, the return did not unfold as expected. Brand recognition held little value when BGI was unable to use its flagship brand, 33 Export. Additionally, the iconic tiger, which had symbolized La Rue beer for decades, was also used by a much more aggressive competitor with greater resources: Heineken and its Tiger Beer.

In 1997, the Castel Group sold its stake to the Foster’s Group, which was later absorbed by Heineken.

2. Gold Rush Casualties: The Other Stories

BGI is not the only company left behind during this gold rush. Harsh competition and a rapidly changing environment claimed other victims as well:

- The SABMiller Group, despite teaming up with local giant Vinamilk and enlisting Calisto—the coach who led Vietnam to its first ASEAN Football Championship title—failed to make its Zorok brand a success in the market.

- The consumer retail giant Masan Group also attempted, without success, to launch its own brand, White Lion (Sư Tử Trắng).

- The beverage giant Tân Hiệp Phát invested $200 million into launching Laser Draft Beer, only for it, as a Vietnamese news article put it, to “die miserably after eight months.”

I could name even more examples to strengthen my point.

What is crucial to understand is that Vietnam, especially at that time, was overwhelmingly an on-trade market. This meant that the majority of beer consumption occurred in bars, restaurants, and clubs.

The major players, who had already secured control of these points of sale through various exclusivity deals, made it increasingly difficult for new entrants to break into the market. As promising as the market was, these aggrements significantly reduced the effectiveness of competitors’ marketing efforts aimed directly at consumers.

3. Sabeco / Habeco

After reading about so many companies failing to capitalize on this “golden opportunity,” you may wonder: who occupies this market now?

The first two names to mention are Sabeco and Habeco.

From entirely state-owned enterprises to fully privatized, publicly listed companies, they have managed to transform themselves and maintain strong positions in a fast-changing and growing market. I won’t outline every step of their transformation, but it’s important to emphasize the scope of these changes.

Take Sabeco as an example. Under its “old name,” Nhà máy Bia Sài Gòn, the company produced approximately 21.5 million liters of beer per year in 1977. Today, that figure has grown to 2.4 billion liters annually.

I could elaborate on the introduction of new brands or the construction of new factories, but what truly enabled these two national companies to secure their roles in Vietnam’s reshaped beer landscape was their shift in legal structure.

Here are some key milestones:

- 2003: Both state-owned companies are restructured to incorporate additional activities and adopt the names we recognize today—Sabeco and Habeco.

- 2008: Both companies become joint-stock companies, opening the door to private capital investment.

- 2008: Carlsberg becomes a strategic investor in Habeco, initially acquiring a 10% stake, which later increased to 17.5%.

- 2016: Both companies are listed on the local stock market.

- 2018: ThaiBev acquires a majority stake in Sabeco.

This shared timeline might suggest that both companies enjoyed similar success, but the reality tells a different story:

- Habeco, with its brands Hanoi Beer and Trúc Bạch, holds a declining 7% market share, with a presence primarily concentrated in northern Vietnam. This relatively poor performance has deterred Carlsberg from further increasing its stake in the company.

- Sabeco, on the other hand, holds a market share of more than 34% with its flagship brands Bia Saigon (and its variations) and 333 . That said, this position has been gradually declining.

With the two former state-owned companies now controlling less than 50% of the Vietnamese beer market, it’s clear that a few new entrants have achieved impressive success.

4. Carlsberg

Carlsberg, previously mentioned for its stake in Habeco, is one of them, with its presence in Vietnam extending far beyond that investment.

The group has been heavily investing in the Vietnamese market since 1993 and is the company behind the ‘local’ beers Halida and Huda.

The names of these two brands directly appeal to their origins:

- Halida is a contraction of three terms: Hà Nội, Liên Doanh (Joint Venture), and Đan Mạch (Denmark).

- Similarly, Huda combines Huế with Đan Mạch.

In addition to these two brands, Carlsberg holds a strong foothold in the premium beer segment—the most profitable part of the market. Its portfolio includes the eponymous Carlsberg beer, Tuborg (introduced in 2016), and more recently, 1664 Blanc.

As of 2023, Carlsberg’s brands represented 9% of the Vietnamese beer market.

5. Heineken

I saved the biggest piece for last: Heineken.

As of 2023, the group held an impressive 43% share of the beer market and, according to its official publications, accounted for 0.9% of the country’s GDP.

A significant part of this success stems from Heineken’s early move in 1991 to establish a joint venture with Foodstuffs Company (later part of SATRA).

From there, the company quickly launched two brands that became massive successes:

Heineken

Locally brewed since 1994, Heineken was not entirely unfamiliar to the local market. Before then, it was often considered the “imported luxury beer” served in international hotels for special guests during the “subsidy period.” This early association with exclusivity helped the brand establish a strong position from the start in the lucrative ‘high-end’ segment.

Tiger Beer

Already well-known in other Asian markets, Tiger Beer began production in Vietnam in 1993. Positioned as more “premium” than 333 or Hanoi Beer but sold at a very competitive price, it quickly captured a significant market share. Tiger Beer’s success became a cornerstone of the group’s achievements in Vietnam.

Larue

These are just two of the many beers in Heineken’s portfolio available in the Vietnamese market. While I won’t list them all here, I’d like to return to one particularly iconic name: Larue.

As previously mentioned, Larue, the first locally produced beer in South Vietnam, is now produced under Heineken’s umbrella.

Its label proudly declares “Since 1909.” but if you’ve been following my article series, you’ll understand that this tagline does not capture how much has changed in both the beer industry and the country since then.

6. What About AB InBev?

A final word for those wondering about Anheuser-Busch InBev (AB InBev), the largest brewer in the world and the name behind brands like Budweiser, Hoegaarden, and Leffe.

The group has been present in the Vietnamese market since 2012 but only opened its first brewery in the country in 2015. Interestingly, a significant portion of its local production is exported to other Southeast Asian markets.

Unlike its competitors, AB InBev has not yet aggressively pursued partnerships with restaurants, bars, and clubs, which account for the majority of Vietnam’s beer market volume.

That said, AB InBev products are becoming increasingly visible in the growing number of supermarkets and retail stores, allowing the group to expand its presence in the country steadily.

Conclusion

If this succession of names and figures has left you a bit lost, here’s a quick recap of the current beer market landscape in Vietnam:

Four brands dominate, accounting for about 93% of the market share:

- 43% for Heineken

- 34% for Sabeco

- 9% for Carlsberg

- 7% for Habeco

If you’re a beer enthusiast like I am, this might paint a grim picture, where the market is dominated by multinationals offering very similar beer products, with labels and marketing being the only real differentiators.

Luckily, this does not take into account the emergence of a truly local and dynamic craft beer scene in the country starting from 2014.

But that deserves its own story. To be continued…

A History of Beer in Vietnam 🍺

- Part 1: The Early Days

- Part 2: Colonial Capitalism

- Part 3: The War for Independence and the Nationalizations

- Part 4: Brewing in a Socialist Economy

- Part 5: Đổi Mới—The Golden Opportunity for Multinational Firms

4 Comments

Great articles! These gave me valuable insights toward Vietnam beers.

Thank you !

Should count HUDA beer in, they are the most popular beer in central Vietnam.

I did mention HUDA. It’s owned by Carlsberg 🙂